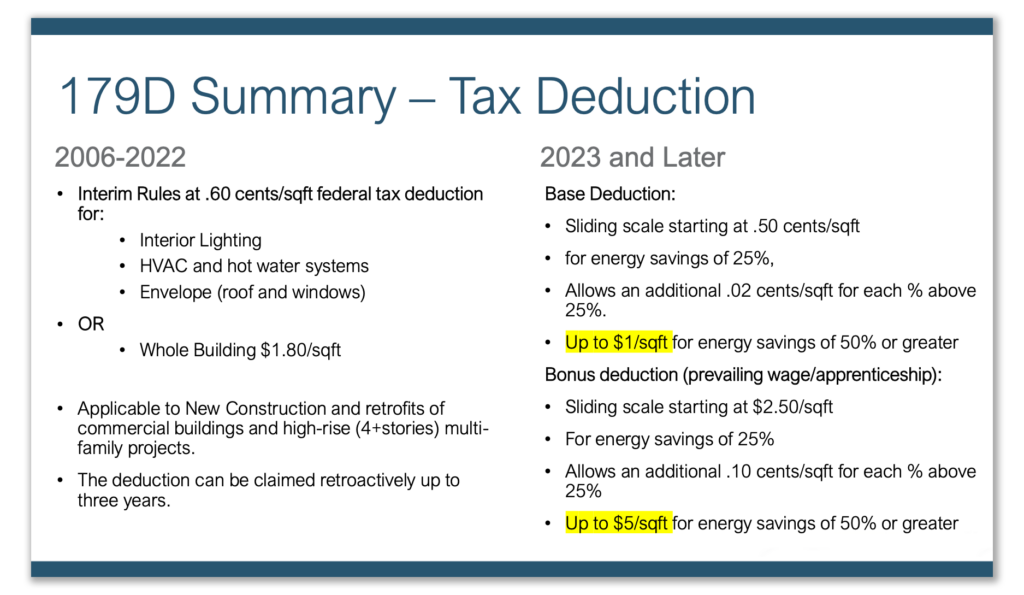

We’ve all been hearing a lot about the many new federal grant programs, specifically the Inflation Reduction Act (IRA). You may have heard that billions of dollars in the Inflation Reduction Act have been earmarked for electric vehicle charging. But have you heard about the enhancements to the 179D tax credit included in the IRA? This tax credit can be used for lighting retrofits and HVAC and, with recent changes, has the potential to save commercial customers a LOT of money on their taxes.

The 179D tax credit has been available since 2006, and we have submitted dozen of government projects that we designed under this program, offering tax deductions to FSG. However, the benefit of this program as a selling tool for tax-paying customers who could take the deduction themselves never really took off for us, with the rate set at only 60 cents per square foot for lighting. But now, thanks to new funds from the IRA, the value of this benefit has been greatly increased and it becomes a great selling tool for us! If the prevailing wage is being paid and we have an apprenticeship program, deductions can reach as high as $5 per square foot!

If you’d like to learn more about how this program works, download the attached PowerPoint Presentation below. Feel free to reach out to me if you have any questions.

– Bernie Erickson

We believe in celebrating important moments in our employees’ lives. If you have a story about an employee or a project you’d like to see on FSG Resources, please share it! Whether it’s a personal achievement or a team accomplishment, we want to recognize and celebrate your successes. Reach out to Scott Delony, FSG Marketing Communications Manager, at [email protected] with stories, ideas, or questions!